In today's world, strong risk management isn't optional for any

business — it's a core part of running professionally and

sustainably. Every organisation has a wide range of risks to

identify, control, and review on an ongoing basis, whether

they're operational, safety, financial, legal, reputational, HR,

IT/cyber, or privacy-related.

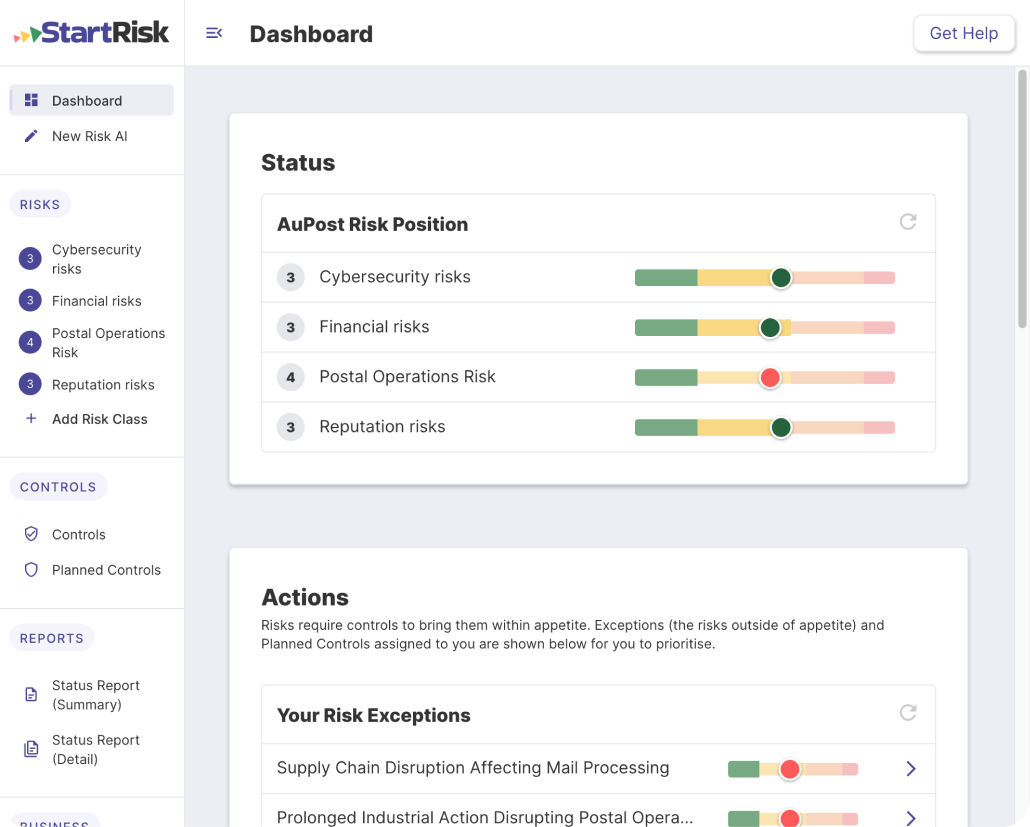

As an NDIS service provider, having a robust, auditable risk and

compliance system is essential. StartRisk has given us a clear,

scalable way to manage our risk register, assign owners, track

actions, and stay on top of review dates with automated

reminders, backed by a strong evidence trail and reporting that

makes compliance easier to demonstrate. It also made it

straightforward to set up risk management in line with the NDIS

Practice Standards and Quality Indicators.

StartRisk was critical to our Registered NDIS Provider approval

and keeps us audit-ready. The platform is simple to use but

sophisticated in capability, with an impressive use of AI that

makes managing risks and controls more efficient.

It's not just the software: the StartRisk team has been there

with us throughout the journey, providing hands-on support and

guidance to get it set up properly and keep improving over time.